On average, it will require about four months to finish the Specialist certification on a component-time foundation of fewer than 4 hrs of study weekly. However, if you have the perfect time to dedicate much more time each week to on-line Finding out, you may complete Intuit’s bookkeeping certification in less time.

Some entities dealt with as companies might make other elections that permit corporate income being taxed only within the shareholder degree, rather than within the corporate degree.

For businesses to prosper and stay competitive, it is important to understand how corporate taxation performs And exactly how it influences day by day functions like funding general public companies, infrastructure and governing administration initiatives that enable maintain the overall economic climate.

Some point out corporate tax returns have sizeable imbedded or attached schedules associated with characteristics on the state's tax method that vary with the federal procedure.[82]

Earning a bookkeeping certification is usually a important expense in the bookkeeping or accounting occupation. Although it is not expected, finishing a comprehensive study course from the respected establishment boosts your skills and demonstrates to possible companies that you simply’re reliable and committed.

Domestic and overseas companies inside the Philippines are matter to corporate revenue tax on their earnings.

Deferring revenue: Companies can decreased their tax legal responsibility by deferring profits Accounting to your long run tax calendar year. This system works well when a business expects to become in a very decreased tax bracket Later on. This tactic operates well in order to defer paying corporate taxes Sooner or later.

When you've got personal or self-used cash flow and truly feel assured applying tax application, you can certainly file on the web with Ramsey SmartTax. If you have additional complex taxes, don’t wish to take the time to perform your own private taxes, or want qualified advice, then a RamseyTrusted tax advisor is for yourself.

PES has utilised diligent attempts to deliver excellent information and product to its prospects, but isn't going to warrant or warranty the precision, timeliness, completeness, or currency of the information contained herein. Finally, the obligation to comply with relevant lawful requirements falls exclusively upon the individual licensee, not PES. PES encourages you to Make contact with your point out Board for the most up-to-date information and to verify or explain any inquiries or fears you have pertaining to your obligations or obligations as a accredited Qualified.

Use of up to seven decades of tax returns We've got on file for you is out there by December 31, 2025. Terms and conditions may possibly change and so are subject to alter without warning.

Whatsoever you would like enter your location over and we’ll do many of the legwork to get you quotes from tax resolution specialists in your area - quickly and free.

It’s most likely because there isn’t a RamseyTrusted pro available close to you at this moment. If that’s the case, you’re matched with our nationwide tax partner who’s uniquely competent to provide the tax needs of all 50 states.

Itemized deductions claimed on Routine A, like charitable contributions, medical fees, home loan curiosity and state and local tax deductions

At any time, wherever: Access to the internet essential; conventional details costs utilize to obtain and use cellular application.

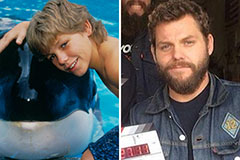

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!